Investor relations

Preferred partner during the journey towards a cleaner tomorrow

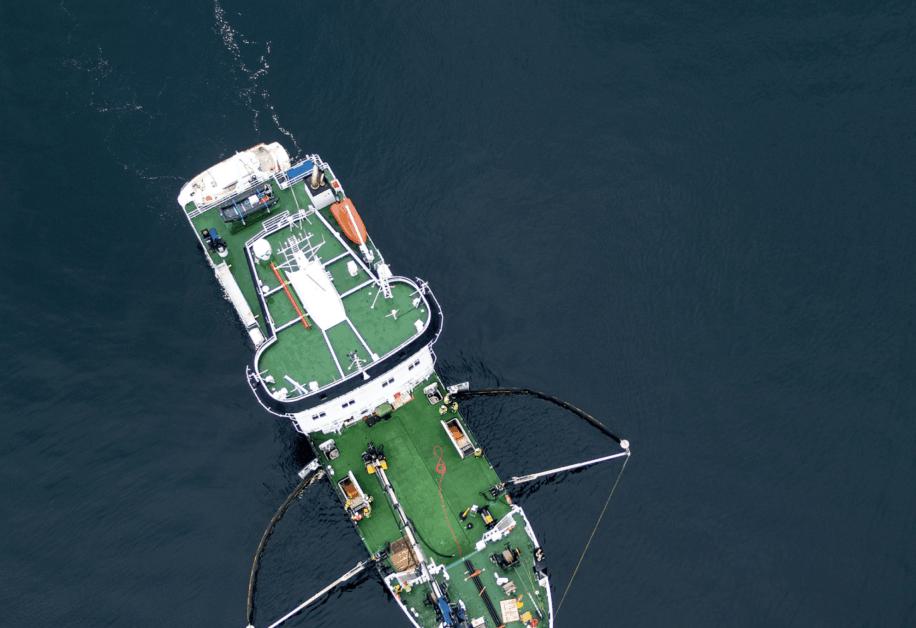

Lamor is one of the leading global providers of environmental solutions. We are specialised in environmental protection, soil remediation, and material recycling to be able to solve huge global problems.

Get our latest press and company releases to your e-mail.

Subscribe hereLamor Last 19/09/2022 10:31 EET Latest € 3.96 Change +0.36€ / +0.36% Volume 12,347

Lamor Last 19/09/2022 10:31 EET Latest € 3.96 Change +0.36€ / +0.36% Volume 12,347

Lamor Last 19/09/2022 10:31 EET Latest € 3.96 Change +0.36€ / +0.36% Volume 12,347

Lamor Last 19/09/2022 10:31 EET Latest € 3.96 Change +0.36€ / +0.36% Volume 12,347

123M€

Revenue 2023

10.9M€

Adjusted EBIT 2023

124M€

Order backlog 31.12.2023

Read about our key figures from 2019-2023

Read more

Strategy

Profitable and sustainable growth - with passion.

Lamor’s strategy aims for long-term growth and a leading position within selected areas and industries. Together with our partner and customer network we promote circular economy, protection of biodiversity and careful use of scarce natural resources.

Investor relations

Strategy

Our key target is to be the world´s leading provider of environmental solutions and a link to sustainability. Here you will find information on our strategy and markets.

Financial information

Find Lamor's latest financial information, guidance and key figures 2019-2022.

Shares and trading

Trading with Lamor's share on the official list of Nasdaq Helsinki Ltd.: information on the shares and shareholding

Debt financing

Information on Lamor's debt financing incl. financial risk management, green finance framework and instruments.

Reports and presentations

Lamor’s financial performance, quarterly results and investor presentations.

Releases

Lamor's stock exchange, company and press releases. Other news and articles are available in the News section, accessible from the footer.

Governance

Lamor's Corporate Governance structure and the Code of Conduct.

IR Calendar and contacts

Browse Lamor's upcoming IR events and save them to your calendar.